are car loan interest payments tax deductible

If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of the time then the person can only deduct 40 percent of the loan. The answer to is car loan interest tax deductible is normally no.

Auto Loan Calculator Navy Federal Credit Union

The costs you can deduct with the actual.

. 50 of your cars use is for business and 50 is personal. 10 x the number of days for which interest was payable. The same is valid for interest.

Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include. Typically deducting car loan interest is not allowed. Experts agree that auto loan interest charges arent inherently deductible.

Normally the interest paid on personal loans credit cards or car loans are in most cases not tax-deductible. Heres an example. While you cannot deduct the 1500 payments you make on the principal loan amount you can deduct the 500 a month you pay in interest.

While typically deducting car loan interest is not allowed there is one exception. May 10 2018. Total interest payable for the year or.

To deduct interest on passenger vehicle loans take the lesser amount of either. This is why you need to list your vehicle as a business expense if you wish to deduct the. But you can deduct these costs from your income tax if its a business car.

You can only use a loan as tax-deductible if the vehicle is for. But there is one exception to this rule. For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns.

Interest paid on personal loans car loans and credit cards is generally not tax deductible. Interest on qualified student loans is tax-deductible. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan.

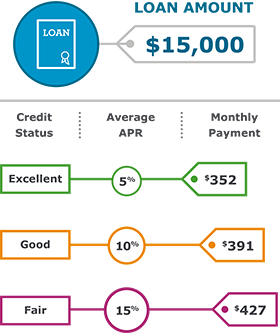

However for commercial car vehicle and. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500. For example if your car use is 60 business and 40 personal youd only be able to deduct 60 of your auto loan interest.

You can write off up to 100. Similarly interest paid on credit card debt is also generally not tax-deductible. It can also be a vehicle you use for.

If you use your car for business purposes you may be allowed to partially deduct car. F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of.

Investment interest limited to your net investment income. Interest paid on personal loans such as a car loan or a furniture loan is not tax-deductible. Of course there is a caveat and its why most people cant use their loan payments as a tax deduction.

Driving Down Taxes Auto Related Tax Deductions Turbotax Tax Tips Videos

Auto Loans And Car Financing Truist

Can I Write Off My Car Payment Keeper

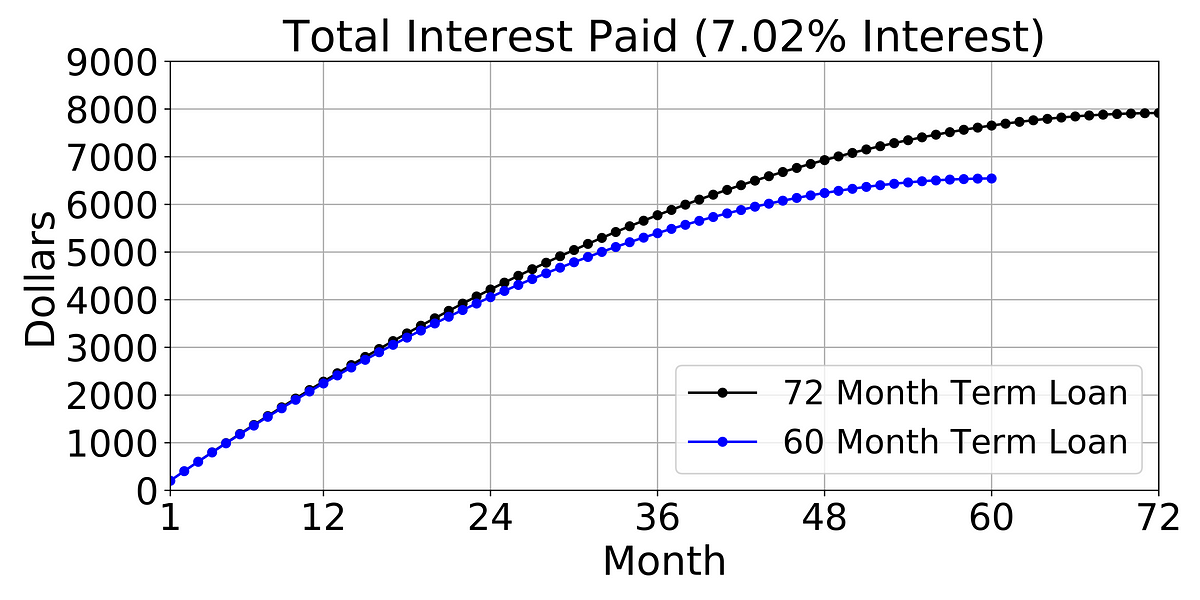

The Cost Of Financing A Car Car Loans By Michael Galarnyk Towards Data Science

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

Personal Loans Vs Credit Cards What S The Difference

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Is Car Loan Interest Tax Deductible Lantern By Sofi

How To Get A Loan From A Bank Wells Fargo

Is A Car Loan Interest Tax Deductible Mileiq

Can I Transfer My Car Loan To Another Person Credit Com

What To Do When You Can T Afford Car Payments

Auto Loan Interest Rates Hit 10 Year High According To Edmunds Harvester Financial Credit Union

What Minimum Credit Score Do You Need To Buy A Car Nerdwallet

What Is A Good Interest Rate For A Car Loan Mercedes Benz Of Newton

How Do Car Loans Work What You Need To Know Credit Karma

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments